What is a bid-ask spread?

The global trading landscape has evolved tremendously over the past decades. Instead of a simple stock market, we now have a sprawling international trading environment that grows without interruptions and invites any aspiring investors. As of 2023, we have seen unprecedented trading volumes in the financial market history.

Today, we want to discuss one crucial concept that serves as a fundamental mechanism in the global trading market – the bid-ask spread. Without this handy trading methodology, our global markets would not be nearly as active and accommodating for traders and investors. So, what is the bid-ask spread, exactly?

Bid-ask Spread Explained

A Bid-ask spread is the variance between a bid price and an ask price on a particular currency or financial asset on the market.

It is widely known that any financial market needs ample liquidity to thrive and expand. Without a bid-ask spread concept, money markets would lose an essential aspect – liquidity providers since they would no longer have a profit incentive to purchase and sell assets.

To understand this concept wholeheartedly, we must define bid price and ask price concepts. You see, trading markets are built on relative stability and price anticipation. After all, traders need a solid price quote present on the market to execute deals. Since we are dealing with a free market, supply and demand prices accumulate through an accumulation of interests around the globe.

Bid Price vs. Ask Price

In short, market demand determines what a given currency is worth in terms of purchase and sell prices. To visualize this concept further, imagine you are a trader on the money market and wish to purchase a particular currency Y. The price of this currency presented by various exchanges, brokers, banks, and other parties worldwide is the asking price.

Conversely, if you wish to sell the currency Y, your target is the bid price – the highest price the counterparties will give you in exchange for this transaction.

The spread, as discussed, is the amount in between these figures. That is where numerous market participants generate their income, making the financial market function smoothly. But who are these counterparties willing to purchase and sell high volumes of liquid assets throughout the market?

Market Makers

Now we have arrived at the final piece of the bid-ask spread puzzle. Market makers are parties of various sizes and functionality that purchase and sell financial commodities on the market. They utilize the bid-ask spread as their primary source of income, using this price variance to make their liquidity provision efforts profitable.

Due to this reason, market makers act as the stability and activity pillars for the money industry. They ensure the market always has the appropriate liquidity in exchange for small bid-ask spread profits.

The entire bid-ask spread methodology was created to accommodate their continuous liquidity provision, and, as a result, the financial enjoys increasing trading volumes. Now, to further emphasize the importance of bid-ask spreads, let us examine a practical example:

Use Case:

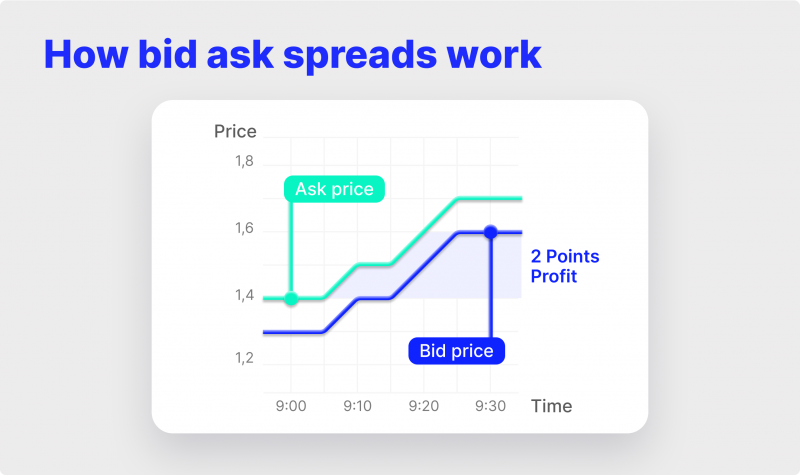

How the Bid-Ask Spread Works in Practice

For a simplified example, imagine a small exchange market with a single currency and two participants – a buyer and a seller. These two counterparties have aligning interests in the same stock of currency X. Currency X is currently valued at $ 1.6, and the seller owns all of it. On the other hand, the buyer wants to purchase this financial asset for their purposes, but their highest purchase price is $1.0. However, the seller’s lowest price is $ 1.6.

These two participants are at an apparent stalemate without a middle party to alleviate the situation. None of the participants want to eat up the losses due to the desires of another. So, the exchange deal is frozen, with no foreseeable resolutions.

Let us introduce a market maker in this scenario to save the day. This third party purchases the specified currency at $ 1.2 and immediately sells it at $ 1.4. Now, both parties have a more favorable position to obtain. Buyers and sellers in this market now have a $ 0.2 improvement on their deals, increasing their potential profits and probably making the deal happen.

This is the power of market makers, letting the liquidity flow on the market and making the transaction opportunities more lucrative for all participants involved. And for that, they take the bid-ask spread as a reward. You see, without a bid-ask spread, which turned out to be $ 0.2 in our example, market makers would have no incentive to supply their funds, thus leaving the money markets without vital liquidity.

Key Takeaways

- Bid-ask spreads need to be calculated with precision and optimal understanding of the market. Liquidity providers must maintain a balance between making profits and keeping traders happy.

- Narrow bid-ask prices demotivate liquidity providers, while wide spreads are unfavorable for the traders.

How to Calculate a Perfect Bid-Ask Spread?

Now that we have gauged the concept and critical value of bid-ask spreads let us segway into how they are calculated. Spreads are derived according to the market conditions. Liquidity providers spend time and resources to come up with the most optimal figures to keep everyone happy and let the market trade actively.

While there is no objective strategy for determining the perfect spreads, it comes down to the current supply and demand conditions on the market. It is important to understand where a given segment stands since going wide or narrow could easily disrupt the equilibrium. Let’s discuss this.

Why Wider Bid-Ask Spreads don’t Work

While a market maker could charge a wide bid-ask spread, it is not a profitable business practice. Wider spreads mean fewer profits for both counterparties on opposite sides of a market maker, and if pushed too far, these parties might simply decide that the deal is no longer worth it.

So, market makers must analyze the sector diligently and come up with a spread that makes sense for all parties involved. After all, without sellers and buyers showing interest, market liquidity would be of no practical use.

The Problem with Narrow Bid-ask Spreads

On the flip side, a narrow bid-ask spread presents problems of its own. Market makers need to receive a certain amount of profit to stay within the industry. If a given exchange segment becomes too stringent with its price preferences, a market maker could simply pack up and move to a different sector.

In this case, liquidity could plummet, and all involved parties would be worse off since they would no longer receive any improvement on quoted prices. So, choosing an optimal bid-ask spread is quite tricky. However, liquidity providers well-versed in money markets have mastered the demanding art of setting optimal bid-ask spreads.

The key here is understanding and accounting for different variables in a given segment. Some sectors have high volumes and high demands, brimming with traders and transactions. In this environment, market makers need to utilize narrow bid-ask spreads, as there are many options on the market due to increased competition. Conversely, markets with low liquidity can accommodate wider spreads, as they lack the freedom of choice.

Additional Charges and Fees

When calculating a perfect bid-ask spread for your purposes, it is important to remember the transaction cost aspect. Different money markets have varying charges on currency exchange, which will be deducted from your spread profits. In most cases, market makers can clear this cost threshold per unit comfortably.

However, there are certain scenarios where the margin is razor-thin, and your spreads might not turn up positive figures after deducting transaction fees. So, be careful when calculating the stock’s bid price and ask price on any market since it could be a difference between making sizable profits and admitting sunk costs.

Bid-ask Spread Formula

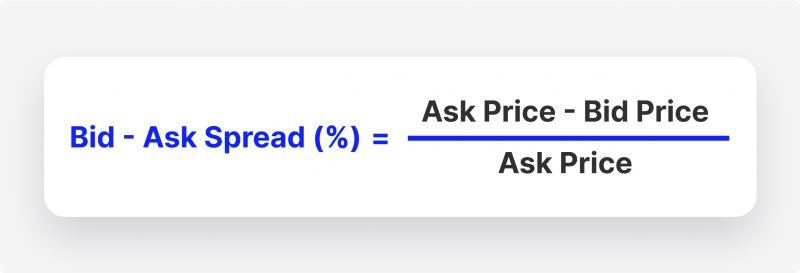

Now, we can combine our accumulated knowledge into a simple formula – a bid-ask spread is calculated as follows:

Lowest asking price – Highest bid price = The spread.

Most traders prefer to calculate the spreads in a percentage format:

While this is a simple deduction, many experts believe that the transaction fees must go into the calculation of every spread. After all, transaction costs are an inevitable part of doing business on the exchange market, and liquidity providers seldom get to keep most of their spread profits.

What Makes a Good Bid-ask Spread?

Now, for the hard part – what is a good price to set on both sides of the equation? The answer here varies significantly depending on the various market conditions for a given liquidity provider. As we discussed, bid-ask spreads often act as a double-edged sword that could hurt either side of the market if swung in the wrong direction.

As a market maker who strives to establish themselves in a given currency sector, you need to weigh your interests against the demand of the traders. While wider spreads might sound inviting to expand your business, you must consider the competition. Segments with less competition will allow you to reap more profits through liquidity provision.

On the other hand, highly competitive and active currency segments will not engage with you if your spreads don’t stack up to the competition. So, balance is the key here. However, it is also important to remember that most markets transition from high to low liquidity. The conditions in a given segment could change rapidly, and your spreads must follow accordingly.

Making a Profit from Bid-ask Spreads

Understanding the bid-ask spread profits is crucial if you’re considering becoming a market maker or liquidity provider. While the above-stated formula gives a simplified answer, you must consider your capabilities before entering the market.

As a rule of thumb, market makers with limited funds fare better on segments with low liquidity. That environment is more profitable for LPs with lower liquidity volumes since there is an opportunity to set higher bid-ask spreads. Naturally, the opposite is true for large market makers since the increased volume of highly liquid markets can turn into significant profits.

However, the most essential aspect to consider is the decision to provide liquidity in the first place. It’s crucial to remember that money markets are volatile and fast-paced. Newcomer LPs can often get stuck with a devalued currency that no longer offers a good spread. So, before you decide to inject your funds into a certain financial asset, you should have a firm grasp of the underlying market trends.

In Summary

Bid-ask spreads have been around since the invention of the money markets. They are the necessary mechanism that makes the market maker’s involvement profitable. As a result, we witnessed a Pareto improvement for all trading parties involved.

However, this concept is also highly contextual and varies wildly depending on the given niche. So, aspiring liquidity providers should study the ever-evolving market conditions closely to come up with a feasible and profitable spread.

In many cases, following the industry trendsetters is a dominant strategy. However, if you aim to achieve significant growth from humble beginnings, taking chances with low liquidity sectors could be the missing ingredient.

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Recent news

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer